TLDR: Cryptocurrencies integrate artificial intelligence to improve blockchain efficiency, security, and user experience. Key AI applications include automated trading, fraud detection, cybersecurity, and predictive analytics. While AI offers advantages like enhanced trading and robust security, risks include over-reliance, data limitations, and algorithmic bias. Leading AI crypto projects like DeepBrain Chain, Numerai, and Fetch.ai showcase how blending AI and blockchain is shaping the future of digital finance.

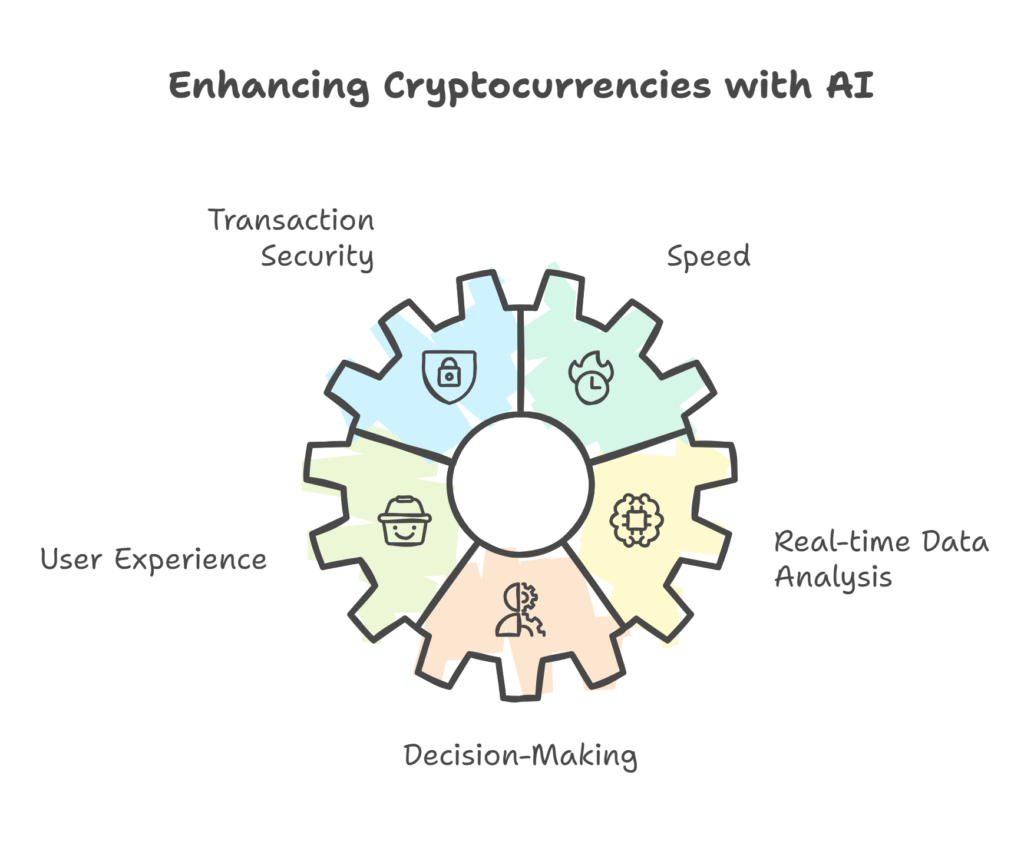

AI cryptocurrencies are a new breed of digital assets that incorporate AI to optimize various aspects of blockchain technology. By leveraging AI, these cryptocurrencies aim to enhance transaction security, speed, and overall user experience. This integration allows for the development of adaptive digital currencies capable of real-time data analysis and decision-making, promoting a more efficient financial ecosystem.

Key Roles of AI in Cryptocurrencies

- Automated Trading: AI algorithms swiftly analyze market trends and execute trades automatically, improving trading efficiency and potentially reducing losses.

- Fraud Prevention: AI can analyze data from multiple sources to detect and prevent fraudulent activities, including money laundering.

- Cybersecurity: AI systems can identify and mitigate cyber threats, uncover vulnerabilities in blockchain networks, and monitor user behavior for suspicious activities.

- Regulatory Support: AI assists regulators in risk identification, policy formulation, and enhancing transparency within blockchain operations.

- Predictive Analytics: Machine learning models analyze both historical and real-time data to forecast market trends, helping investors make informed decisions.

- Smart Contract Optimization: AI can enhance the responsiveness and adaptability of smart contracts to better meet user needs.

Risks Associated with AI in Cryptocurrency

- Excessive Dependence: Over-reliance on AI could lead traders to overlook critical market changes, resulting in poor decision-making.

- Data Limitations: The relatively immature cryptocurrency market provides limited historical data for training AI algorithms, potentially leading to inaccuracies.

- Transparency Issues: The complexity of AI algorithms can obscure their decision-making processes, which may deter traders from trusting their predictions.

- Cybersecurity Vulnerabilities: Evolving AI systems may become targets for cyberattacks, posing risks to the security of traders’ funds.

- Bias in Algorithms: If the training data is biased, the predictions made by AI will also be biased, potentially resulting in significant financial losses.

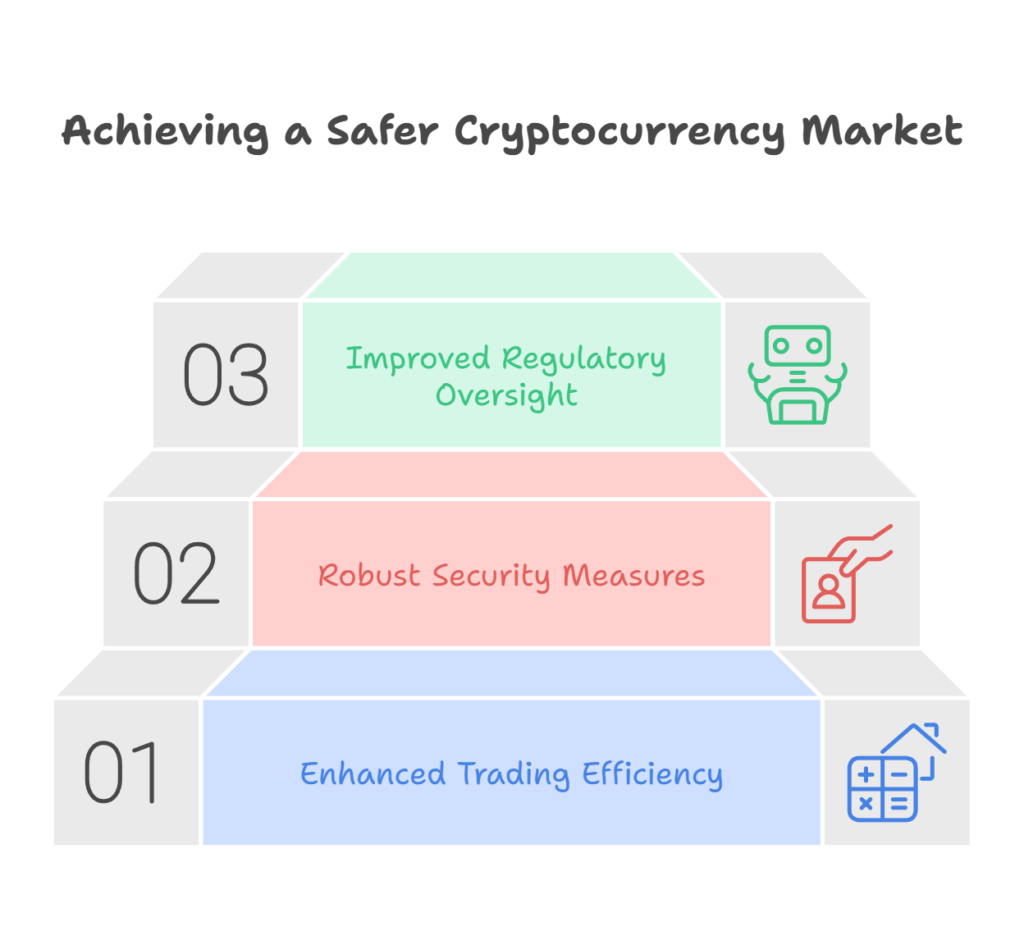

Advantages of AI in Cryptocurrency

- Enhanced Trading Efficiency: Intelligent algorithms can quickly analyze market dynamics, execute trades, and manage risks, potentially increasing profitability.

- Robust Security Measures: AI systems can detect fraudulent activities, scrutinize transactions for irregularities, and adapt to new threats, creating a safer trading environment.

- Improved Regulatory Oversight: By aiding regulators in identifying risks and formulating effective policies, AI enhances transparency in the cryptocurrency market.

Notable AI Cryptocurrencies

- DeepBrain Chain (DBC):

- Cost Reduction: Uses a distributed network to reduce AI computational costs.

- Token Utility: DBC tokens are used for transactions and incentivizing participation in the ecosystem.

- Numerai (NMR):

- Incentivizing Data Scientists: Rewards global data scientists with NMR tokens for contributing stock market prediction models.

- Blockchain Transparency: Built on Ethereum, it ensures transparent contributions and automated payments through smart contracts.

- Fetch.ai:

- IoT Connectivity: Connects Internet of Things (IoT) devices through a blockchain platform for autonomous interaction.

- Autonomous Agents: Employs Autonomous Economic Agents (AEAs) to perform tasks independently, such as negotiating deals.

Conclusion

AI cryptocurrencies represent a significant evolution in the cryptocurrency landscape, combining the strengths of AI with the decentralized nature of blockchain. While there are clear advantages in terms of efficiency, security, and regulatory support, stakeholders must also be mindful of the associated risks. As the sector matures, the integration of AI will likely play a crucial role in shaping the future of digital finance.

Sources:Tokenmetrics Blog, RapidInovation Post.