To understand industry cloud adoption trends, we leveraged Google’s NotebookLM to analyze Gartner’s SCPS Magic Quadrant.

The tool demonstrated its ability to suggest suitable cloud platforms for different industries based on specific prompts. However, it’s crucial to remember that AI-generated content may contain inaccuracies. Always independently verify any critical information before making decisions.

With the context of Gartner® Magic Quadrant™ for Strategic Cloud Platform Services, we extracted the below insights with NotebookLM.

Prompt

Which cloud provider is the best fit for financial industry based on this report.

Response

Based on the provided excerpt, Oracle and Google appear to be strong contenders for the financial industry due to their focus on digital sovereignty and industry-specific solutions.

- Oracle positions itself as a leader in sovereign cloud solutions, catering to strict regulatory and data privacy requirements with various deployment options. This is particularly important for the financial industry, which is heavily regulated. Oracle also concentrates on positioning OCI as the optimal platform for deploying Oracle software. As many financial institutions already rely on Oracle’s financial software solutions, this integration could be beneficial.

- Google offers solutions for digital sovereignty through Google Assured Workloads and the Google Distributed Cloud (GDC) portfolio. While the excerpt doesn’t explicitly mention Google’s industry-specific solutions for finance, it highlights Google’s understanding of traditional enterprise needs and its focus on cloud-native architectures and AI. These capabilities could be relevant to financial institutions seeking to modernize their infrastructure and leverage AI/ML for tasks like fraud detection and risk management

It’s important to note that the provided excerpt doesn’t offer a comprehensive analysis of all cloud providers’ offerings for the financial industry.

To make a well-informed decision, you should consider additional factors such as:

- Specific security and compliance requirements of the financial industry: You need to assess each provider’s security certifications, compliance offerings, and data encryption capabilities.

- Cost-effectiveness and pricing models: Evaluate the pricing structures of each provider and compare them based on your specific usage patterns and workload requirements.

- Integration with existing systems: Consider how well each provider integrates with your existing financial systems and applications to ensure a smooth transition and minimize disruption.

You may want to consult additional resources, such as industry analyst reports and case studies of financial institutions using different cloud providers, to gather a broader perspective on the best fit for your specific needs.

By providing specific prompts to NotebookLM, we were able to uncover a wealth of insights into cloud adoption trends.

Take a look

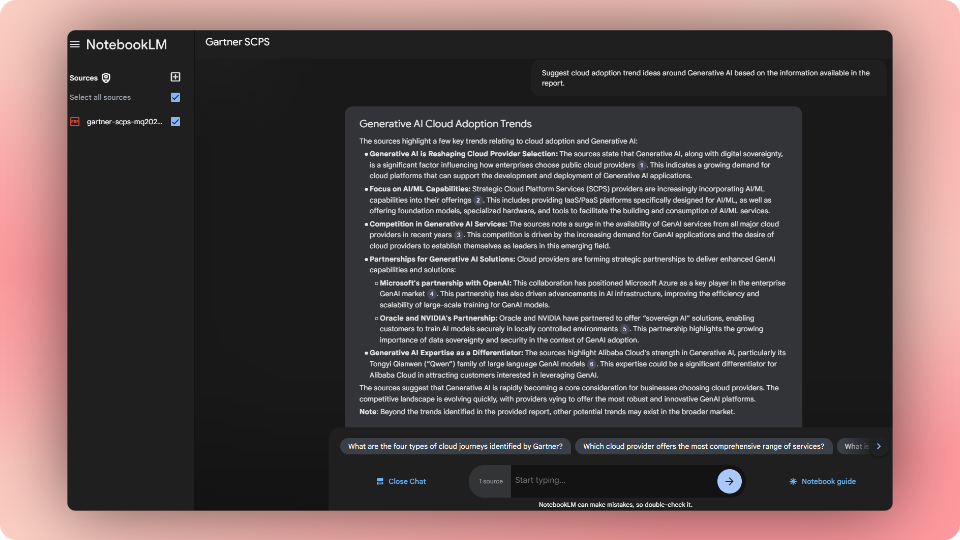

Prompt: Suggest cloud adoption trend ideas around Generative AI based on the information available in the report.

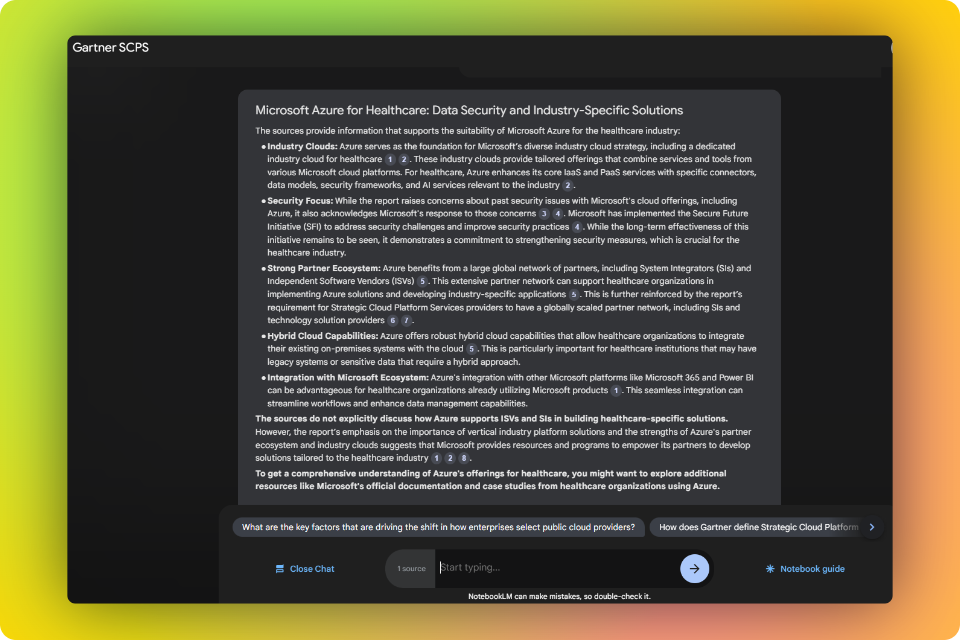

Prompt: Based on the information in the analyst report suggest how well Microsoft Azure cloud is suited to support the healthcare industry to secure the data as well as support System Integrators and ISVs to build industry specific solutions on Azure.

NotebookLM proved to be an invaluable tool, not only summarizing the report effectively but also leveraging its generative AI capabilities to predict future cloud service provider (CSP) adoption trends across various industries.

All of this was accomplished at no cost, making it an accessible and powerful tool for anyone interested in exploring AI-driven insights.

You can go through the full Gartner Report here.